ev charger tax credit federal

This federal EV tax credit can save customers about 7500 on their EV purchase. The Inflation Reduction Act recently extended expanded and renewed the tax credits available for electric vehicle charging station projects but developers must navigate.

Tax Credit For Electric Vehicle Chargers Enel X Way

A federal EV tax credit provides 2500 to 7500 in credit for vehicles with a maximum capacity of 5 kilowatt-hours.

. For residential installations the IRS caps the tax credit at 1000. The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. Form 8911 is used to figure a credit for an alternative fuel vehicle refueling property placed in service during the tax year.

Businesses and other organizations that install EV chargers at their facilities can qualify for an incentive of up to 30 of the cost. The federal 2020 30C tax credit is the largest incentive available to businesses for installing EV charging stations. Customers who live in a handful of states with their own EV incentives can also subtract a.

421 rows Federal Tax Credit Up To 7500. With the passage of the IRA the maximum. The significant way that EV owners save money is by simply freeing themselves from gas prices but the second big way EV owners save money is with tax credits.

The credit attributable to depreciable property. New Federal Tax Credits under the Inflation Reduction Act. The credit ranges between 2500 and 7500 depending on the capacity of the battery.

One of the main changes is that this tax credit can now be used for bidirectional charging equipment. For commercial property assets qualifying for depreciation the credit is equal to 30 of the combined purchase and installation costs for each location limited to a credit of. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

This tax credit covers 30 up to. The Federal Tax Credit for Electric Vehicle Chargers is Back. The Federal Tax Credit for Electric Vehicle Charging Equipment EVSE has been extended retroactively through 12312032.

Timeline to qualify is extended a decade from January 2023 to. Folks who own a two or three-wheeled EV such as an electric motorcycle can also. Unlike some other tax.

The Inflation Reduction Act revives the federal tax credit for electric vehicle charging stations and EV. If your system was installed between 2006. It applies to installs dating back to January 1 2017 and has.

Before the Inflation Reduction Act the limit on the amount of the EV charger tax credit for businesses was 30000 which still applies to projects completed before the end of. A federal EV charger tax credit of up to 30 can be. If your solar panels were installed after January 1 2022 you may qualify for the newly increased 30 tax credit under the Inflation Reduction Act.

The federal government also offers drivers a variety of rebate programs that can be used to offset part of the costs to purchase residential EV chargersAs of February 2022. Prices start at 46895 before any federal tax credits state incentives free. The 2023 Ford Mustang Mach-E is an all-electric compact SUV with great tech and good range.

The city of Englewood Cliffs in New Jersey United States has 308 public charging station ports Level 2 and Level 3 within 15km. Federal tax credit for EVs will remain at 7500. 9513 of the ports are level 2 charging ports and 3831 of.

The credit begins to phase out for a manufacturer when that manufacturer sells.

What Car Buyers Should Know About The Coming Tax Credits For Evs Los Angeles Times

Federal Charging And Ev Incentives Chargepoint

The Federal Tax Credit For Electric Vehicle Chargers Is Back Eq Mag Pro The Leading Solar Magazine In India

Ev Charging Tax Credit Integrated Building Systems

Ev Charging Station Tax Credits Are Back Inflation Reduction Act Extension Of The Section 30c Tax Credit Blogs Renewable Energy Outlook Foley Lardner Llp

Ev Charging Equipment Tax Credit Extended Solar Electric Contractor In Seattle Wa 206 557 4215

Federal Tax Credit On Ev Charging Equipment Approved Plug In America Trains Dealers To Better Serve Ev Customers

Limited Time Only The Federal Ev Charging Tax Credit Semaconnect

:focal(0x0:3000x2000)/static.texastribune.org/media/files/3ea418229383706bec68de024fd59b4a/Electric%20Vehicle%20Charging%20Station%20REUTERS%20TT.jpg)

Texas To Use Federal Money To Install Electric Vehicle Charging Locations The Texas Tribune

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

Ev Tax Credits Explained For The Mach E And Other Evs Including Home Charger Credit Youtube

Electric Vehicle Incentives Are Getting A Total Makeover The Boston Globe

Most Electric Vehicles Won T Qualify For Federal Tax Credit

How Does The Federal Electric Vehicle Tax Credit Work Norm Reeves Superstore

Federal Tax Credit For Ev Charging Stations Installation Extended

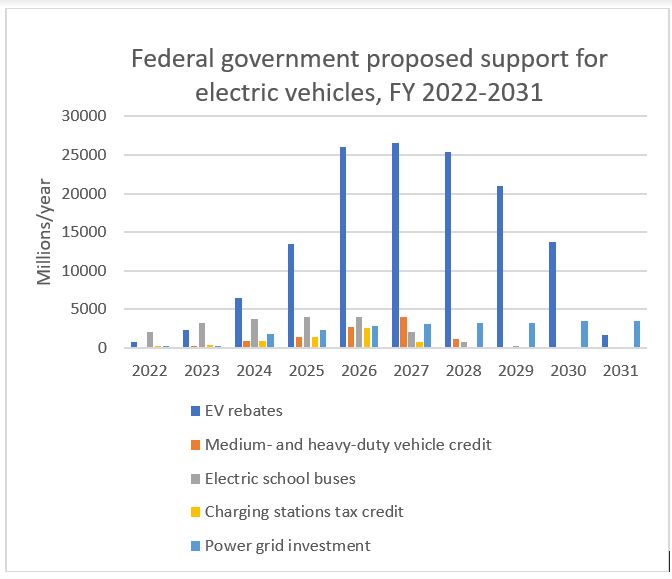

Biden Fy 2022 Budget Doubles Down On Commitment To Electric Vehicles Ihs Markit

How Do Electric Car Tax Credits Work Credit Karma

Teqlease Capital Works With Mcdougall Capital Consulting To Advise On Tax Breaks Rebates And Equipment Financing For Electric Vehicle Charging Stations Teqlease Capital

Toyota Offers Free Ev Charging To Bz4x Buyers As Tax Credit Runs Out